-

(#1) Choose A Less Popular Car

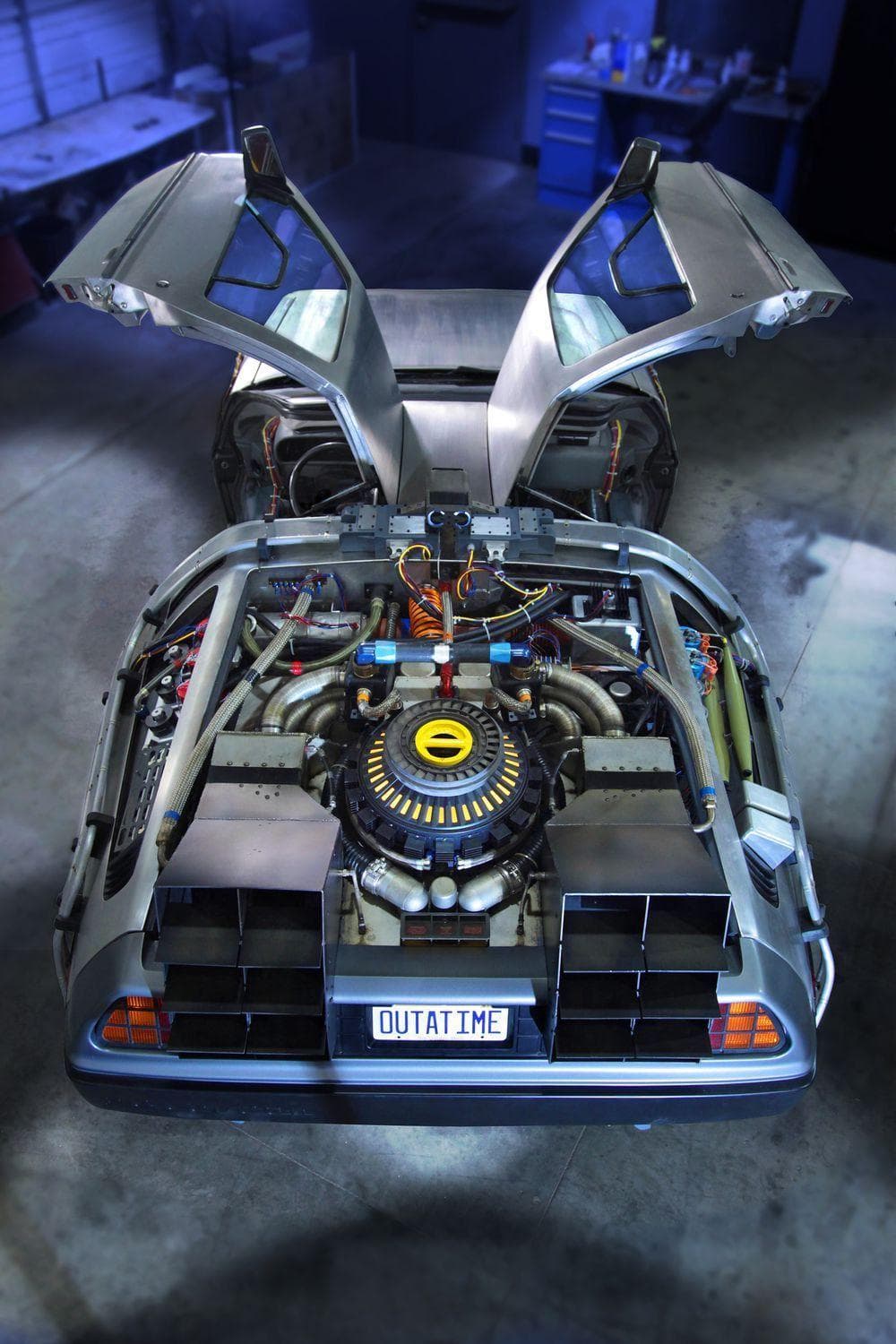

When you're first shopping for a vehicle, consider a less popular car. In-demand vehicles usually come with higher insurance rates. In addition, popular makes and models tend to be more vulnerable to theft. And if you're in an accident, getting replacement parts to repair your car might be more difficult.

For example, if lots of people own the same type of new vehicle, the parts to fix those cars could have a high demand - and price tag.

-

(#2) Know The Minimum Legal Coverage For Your State

Different states have particular minimum legal coverage requirements. Insurance generally provides four types of coverage: bodily injury, property damage liability, personal injury, and underinsured or uninsured motorists. In many states, insurance companies only require bodily injury and property damage liability to meet the bare minimum.

Once you determine the minimum mandatory coverage needed to comply with state law, head online to one of the many insurance sites. Most sites allow you to build a custom plan - choose only the coverage you need, and you might save money while still meeting state standards.

-

(#3) Select A Higher Deductible

Consider choosing a higher deductible when shopping for your car insurance plan. Though a higher deductible does mean an auto accident requires paying more out of pocket until you hit the dollar amount where your insurance kicks in, you will likely save on your initial premium costs.

High deductibles have another advantage, too. For example, if your deductible is $1,500 and you get in an accident that incurs $1,200 worth of damage, you will pay for it all out of pocket, so technically, you don't need to report the accident to your insurer. This will prevent your insurance rates from increasing after the accident.

-

(#4) Go To Traffic School

You're probably thinking, "What? I don't need traffic school!" But traffic school isn't only for people who have had an auto accident. Most car insurance companies offer discounts to people who have completed a driver improvement course. In fact, several states even require insurers to offer these discounted rates.

Traffic school is relatively affordable, and you can take many courses online. It's a small time and money investment that could save you considerable money in the long run - and you might learn something useful.

-

(#5) Take Advantage Of Insurance Discounts

Virtually every major car insurer offers a way for drivers to get discounts. Are you a good student with at least a 3.0 GPA? You might qualify for a discount. Do you have a safe driving record? If so, you'll typically be eligible for a discount. Does your car have anti-lock brakes or an anti-theft device? Possible discount! Are you in the military? Discount!

These are only a sampling of the ways you can save. Before signing up for any auto insurance plan, explore all the available discount options and contact insurers directly if you need help.

-

(#6) Be A Safe And Responsible Driver

Insurers like safe drivers. If you cost insurance companies less money, they in turn will likely require less money from you to provide coverage. Nearly all insurance companies offer lower rates to safe drivers. But don't automatically assume that one speeding ticket several years ago causes your rates to skyrocket - a violation has to appear on your current driving record to have an effect.

Minor traffic infractions, such as seat belt violations, broken taillights, and license plate issues, don't affect how much a driver gets charged for car insurance.

-

(#7) Find Out Your Credit Score

Insurance companies use the information on your credit report to predict what kind of driver you are, creating a credit-based insurance score. They assign a coverage amount based at least in part on what they can deduce from your credit report.

If you have a strong credit rating and solid credit history, the odds of getting a more affordable car insurance rate are higher. Check your credit with any of the major agencies and see if you can make improvements or fix any reported errors. Bolstering your credit score even a little could lead to lower rates.

-

(#8) Purchase A Safer Car

Car safety ratings are important to auto insurance rates. These assessments determine how well the vehicle can protect occupants during a crash. In addition, these tests evaluate the efficacy of the car's technology in preventing or mitigating accidents.

The Insurance Institute for Highway Safety maintains an updated annual list of its top auto picks based on safety.

-

(#9) Bundle Your Insurance Plans

If you're hunting for cheap car insurance and need insurance for other areas of your life, too, consider a bundle package. Most major insurers offer discounts when customers combine auto insurance with their home or renters insurance policy. Depending on the insurer, you can save anywhere from 5% to 25% on each policy. In addition, keeping all coverage with a single insurer lets you pay premiums and manage your policy in one convenient place.

And if you do have a major accident and fear your insurer will drop you, the company may reconsider if you carry more than one type of insurance with them.

-

(#10) Pay Your Premium Yearly Instead Of Monthly Or Biannually

Many insurance companies will give you a discount if you pay for an entire year's worth of coverage at one time. This might not be feasible for every driver, but it's an option worth pursuing if you're able to swing it. Installment payments come with additional fees for things like administrative expenses and the risk that you might default.

Paying a yearly amount also offers some protection and peace of mind: You won't need to worry about missing a payment or losing coverage throughout the year.

-

(#11) Drop The Insurance You Don't Need

Some drivers sign up for whatever policy their insurance company recommends, so they might pay exorbitant premiums for coverage and services they don't need. If you meet the mandatory state minimums, you don't legally have to purchase anything beyond that.

Collision coverage, for instance, pays for damage to your vehicle. If you have an older car, getting collision coverage may not be worth it. Compare your current collision coverage payments with your vehicle's value. For example, if you're spending $1,000 annually on collision insurance, but your vehicle is worth only $1,500, dropping this coverage may be financially wise. Your insurance rates could decrease significantly.

Other coverage you may not require includes rental car insurance (your credit card company might offer this if you pay for the rental using a particular card) or roadside assistance (if you already belong to AAA or a similar service through your car company).

-

(#12) Shop Around

You have no obligation to stay with your current insurer for the rest of your driving life. Car insurance providers constantly compete with each other, and rates can fluctuate dramatically. Your quote on Monday may not be what your quote is on Friday.

Shop around every year for other rates to see if a competitor can insure you for a better price. If you accept a better deal, cancel your current policy and enroll in the new one. Most insurers will refund any unused premiums you have already paid on your current plan.

-

(#13) Pay By The Mile

If your annual mileage is low, paying by the mile might decrease your annual insurance rate considerably. Pay-per-mile auto insurance companies set your rates based on how much you drive. They track the mileage using a wireless in-car device. Some companies charge a base rate with a per-mile rate added on - usually a few cents per mile. Others give you a discount after seeing your tracked mileage.

Drivers who benefit the most from this kind of coverage usually drive less than 12,000 miles per year. Pay-per-mile insurance is not available in all states, though.

-

(#14) Buy A Bigger Car

Size matters - a smaller car does not typically mean smaller auto insurance rates. Small, fast cars are statistically more accident-prone, in part because their drivers are often young and inexperienced, but also because their size and speed leads to riskier driving behavior. And more accidents means higher insurance costs.

Russ Rader, a spokesman for the Insurance Institute for Highway Safety, explains why: "Contrary to the idea that smaller cars can help you avoid crashes, the data shows that small cars get into more accidents. If you feel like you have a vehicle that can zip in and out of traffic, chances are you'll do that."

New Random Displays Display All By Ranking

About This Tool

Learn some tips on how to get cheaper car insurance, which may save the money in your pocket. People who work hard to obtain cheap car insurance need to do some tedious work and research. Here are many ways to get cheap car insurance. You can choose a less popular car or check your credit score to get cheaper insurance.

This random tool generates 14 items, including the best way to get cheaper car insurance. These tips are important for everyone if you want to buy a car, you could check the information here. Welcome to leave a message and share your thoughts.

Our data comes from Ranker, If you want to participate in the ranking of items displayed on this page, please click here.