-

(#3) In 1720, Shares of the South Sea Company Were Worth Almost $200k Adjusted for Inflation

Britain's South Sea Company was formed in 1711, and was promised a monopoly on all trade with the Spanish colonies of South America. Expecting a repeat of the incredible success of the East India Company, investors snapped up shares, and they surged more than eight-fold in the first half of 1720, reaching a price of £1,000, or £134,000 adjusted for inflation. A slew of copycat companies started, and England went IPO crazy.

But the South Sea Company was a mess - poorly run and unprofitable, with shipments being misdirected. Company directors realized the Company couldn't possibly deliver on its lofty promises, and sold their shares just as shareholder payments were due. Panic set in, and the Company collapsed in subsequent months. Only direct intervention by the British government saved the UK's economy from going under, and Britain banned the trade of stock certificates until 1825.

-

(#5) In the 1840s, British Railroads Suddenly Doubled in Value

Having retained nothing from the South Sea Bubble, 1840s Britain was gripped by "Railway Mania", a frenzied, speculative railroad building market. In 1830, the first modern city-to-city railroad opened and was immediately successful. Combined with the 1825 repeal of the Bubble Act, an interest rate cut, and a flood of new money from the Industrial Revolution, railways became the hot investment.

Railroad stock prices doubled from 1842 to 1845, and hundreds of new railroad charters were passed by Parliament. But by 1845, it became clear that most of these railroads would be money-losers. Others proved impossible to build, and some were simply scams. A Bank of England interest rate hike finished off Railway Mania, and thousands of people lost their life savings. Of the railroads that did get built, many are still around today, and the boom led to a major increase in the interconnectivity of English cities.

-

(#6) In 2006, Cheap Thai Amulet Sold for Tens of Thousands of Dollars

One of the strangest bubbles in history began with the death of an octogenarian Thai general in 2006. Longtime head of the Thai police, Phantarak Rajadej was renowned for solving a difficult murder case with the help of an amulet bearing the image of the Thai god Jatukam Rammathep. Overnight, demand for the amulets exploded.

Thailand went amulet crazy. Wearers slung multiple Jatukam amulets, all blessed by monks and bearing names like "Super Rich to the Heavens," around their necks. The amulets, which normally sold for $1.20, became the sole commodity in a huge bubble, with some selling for as much as $75,000. The amulet market swelled to a value of more than $600 million. Then, suddenly, Thais began to wonder how so many amulets could actually blessed by monks; were most of them fake? Also, they weren't getting rich or gaining immortality.

The amulet industry went bust almost as quickly as it went boom, leaving thousands of buyers out large deposits, and others stuck with worthless knockoffs. Also, it was found that the Thai god the amulets supposedly paid tribute to wasn't a real god in Thai culture.

-

(#9) In the 2000s, Crummy Communist Apartments in Romania Were Worth as Much as London Flats

A complex series of factors caused property prices in Romania, particularly the capital of Bucharest, to explode. A lack of new apartments being built from 1989 to 2005, combined with a revitalized banking system and high foreign salaries paid to Romanian expats working in the EU, caused prices to increase by as much as 1,000%. In Bucharest, that meant communist-style apartments built in the '60s and '70s were suddenly worth hundreds of thousands of pounds - the equivalent of flats in middle-class London and Paris.

More properties finally started going up, as foreign investors and shady real estate deals flooded the market, causing prices to drop. The 2008 crash hit the country hard, but values remained inflated compared to the rest of Eastern Europe.

-

(#1) In 1630s Holland, Tulips Sold for Ten Times a Craftsman's Income

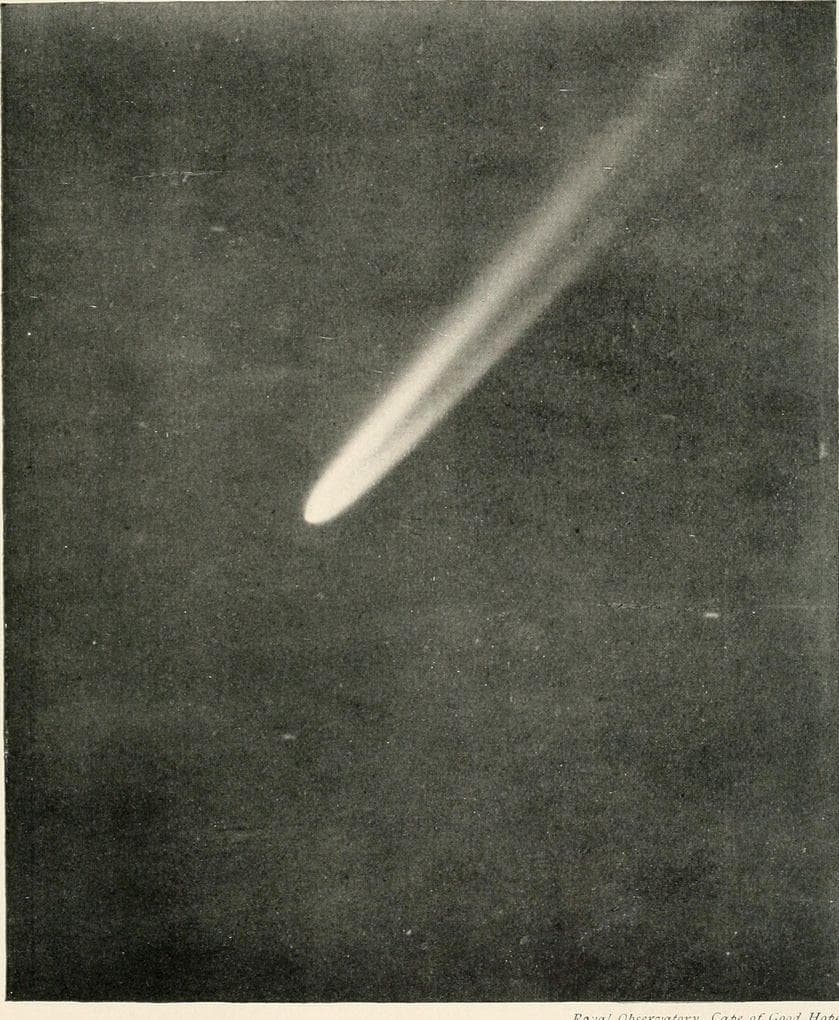

The Tulip mania that gripped Holland in 1636 and 1637 was an asset bubble the likes of which had never been seen. Tulips were introduced to Europe in the 1550s, and their bright colors and hearty build made them the most prized flower on the continent.

In early 1636, the Dutch created a futures market for the tulip bulb, and prices exploded. Within weeks, tulips were being sold and bought by virtually the entire country, with bulbs changing hands a dozen times a day. By late 1636, individual bulbs were worth ludicrous sums of money.

One record has a single tulip root being traded for "Two lasts of wheat, four lasts of rye, four fat oxen, eight fat swine, twelve fat sheep, two hogsheads of wine, four tons of beer, two tons of butter, one thousand lbs. of cheese, a complete bed, a suit of clothes, a silver drinking cup."

But by February 1637, speculators couldn't find buyers for their inflated wares, and tulip mania cooled off. The tulip market crashed by 99% overnight, speculators were wiped out, and Holland's economy took decades to recover.

-

(#10) In 1995, Shares of an Early Social Media Site Were Worth Almost $100

A primitive social media website, theGlobe.com, went live on April Fool's Day 1995, and immediately hit more than 40,000 visitors, a staggering number at the time. The site went public three years later, with a price of $9 per share jumping to $97 and settling at $63.50, all in a single day. It was the single biggest first-day percentage jump ever. The company's co-CEOs were worth nine figures by the end of trading.

But theGlobe.com became a punching bag for tech doubters, given that the site was an amalgamation of chat rooms, message boards, and online clubs. It didn't help that the co-CEOs were obnoxious tech bros with a penchant for self-serving pull quotes and pleather clothes (one was literally dubbed "the CEO in plastic pants").

The bubble burst and sent theGlobe.com shares down to 10 cents. The CEOs were forced out, and the company soldiered on through lawsuits, failed attempts at getting into the VOIP market, and finally, an illegal attempt to poach users from MySpace. It was bought out, and now only serves as a shell company for lawsuit payouts.

New Random Displays Display All By Ranking

About This Tool

The origin of the economic bubble was the Dutch tulip bubble. Since the 17th century, there have been several huge financial crises spreading across the world. During the economic bubble periods, it caused huge chaos in the operation of the society and economy, and the prices of many things soared to absurd levels. An economic bubble is a series of asset price inflation, which rises sharply in a continuous process, its market price far exceeds the value it actually represents.

Speculation is still a trend in modern society, and under its impetus, asset prices continue to rise. Looking back the history, the random tool tells stories of 11 absurdly priced things in history.

Our data comes from Ranker, If you want to participate in the ranking of items displayed on this page, please click here.