-

(#11) Adherence To The Gold Standard Caused The Depression

In the first place, the world hadn't been on the classic gold standard since WWI and instead was using a "gold exchange standard" by the time of the Depression. Under this system, currencies were pegged primarily to the British pound and the American dollar, which, in turn, were redeemable for gold. As the 1920s went on, gold itself played less and less of a direct role in international finance.

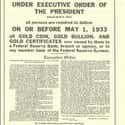

Then, in 1933, FDR actually seized the gold assets of private American citizens. That's right; he used his executive authority to forcibly purchase gold bullion and gold certificates on behalf of the government. This completely liquidated the natural gold exchange system that existed. The executive order essentially made it illegal to own gold, physically or as an asset.

FDR then, thanks to a power granted by Congress, arbitrarily altered the price of the dollar relative to gold. He picked a 21 cent hike because, well, 21 was a lucky number. So, far from creating a stable currency (the purpose of the gold standard), FDR intervened directly to subvert the gold standard and inflate the dollar. If adherence to a gold standard was indeed the cause of the Great Depression, it stands to reason that these actions would have ended it. Instead, the sudden change in the value of money exacerbated the climate of uncertainty plaguing the economy.

-

(#9) Everyone Was Poor During The Depression

While the Depression did have a wide impact, up to 40% of Americans faced no real economic hardship. Some people even managed to get rich during the time period. This period was also considered the Golden Age of Hollywood – when the studio system was at its zenith. Such classics as Dracula, Frankenstein, and Gone With the Wind were all filmed during the 1930s.

-

(#3) People Buying Stocks On The Margin Caused The Stock Market Crash

By 1929, the US stock market was inflated to unsustainable levels, fueled by the oft-derided "stock speculators," and indeed many of the stocks were purchased on the margin. Purchasing a stock on the margin basically means that the purchaser pays a percentage of the stock's cost in cash, and the rest is fronted by a broker or agent. Thus, when such a stock fails, the person still owes the part of the sale that was fronted by the broker.

The problem with attributing the crash to this is that marginal trading was no worse in the 1920s than it had been in the previous decades. Margin requirements actually started to rise by the Fall of 1928.

Instead, some argue that the actions of the Federal Reserve during the 1920s may have helped fuel a stock bubble. Between 1921 and mid-1929, the Fed increased the money supply some 60%. Others suggest that the increased support for the Smoot-Hawley Tariff also played a role in causing the market to crash (it passed the House of Representatives in May 1929).

-

(#2) The Depression Was Limited To The US

While the Great Depression started in the US, it quickly spread outward and became a global event. It gave rise to Fascism and National Socialism in Europe, and, in many ways, it set the stage for WWII. The protectionist policies that began in the US quickly spread around the world, causing international trade to grind to a virtual standstill.

-

(#1) The Depression Was Caused By The 1929 Stock Market Crash

In reality, the 1929-30 recession was less severe than the one in 1920-21. Yet, while 1921 saw an economic boom, 10 years of economic hardship followed 1930. So, if it wasn't the stock market crash, then what did cause the Great Depression?

First, keep in mind that the number-one characteristic of the Great Depression was high unemployment. After the 1929 crash, unemployment spiked, but it didn't reach double digits, peaking at 9%. It was actually on the mend, falling to 6.3% by June of 1930.

That month, the Smoot-Hawley Tariff was passed. While the tariff was pitched as a way to tax imports and thus incentivize the production of goods domestically, 1,000 economists from the leading public universities signed a public appeal against the act. The tariff spawned retaliatory tariffs in other countries that made it harder for Americans to sell their goods abroad. Within five months of the passage of the bill, unemployment reached double digits for the first time, where it stayed for the rest of the 1930s.

The tariff was the first of many misguided government interventions that were largely the cause of the Depression. Some have argued that the Federal Reserve's loose monetary policy of the 1920s, which was followed by a tight monetary policy in the early 1930s (dubbed The Great Contraction), played the biggest part in creating the Depression, while others hotly contest that theory.

-

(#8) Banks Closed Because They Didn't Have Access To Credit

On the contrary, the Federal Reserve was created in 1913 for the explicit purpose of being the lender of last resort when transactions between banks dried up. So why did so many banks close between 1929 and 1932?

At the time, many states in the US had unit banking laws. Basically, these made it illegal for large banks to open branch locations in certain places. Unit banks, on the other hand, are small banks that operate independently, serving a single specific location. While branch banks are backed (and ultimately controlled) by large financial institutions, unit banks are not.

The McFadden Act of 1927 explicitly banned interstate branch banking. Without access to a widely diversified financial backer, unit banks are much more sensitive to financial downturns. The widespread reliance on unit banking (by law) in the US was a major reason so many banks closed. Analysis has found that states that allowed branch banking saw fewer bank failures during the Depression. Further, Canada, which had no laws against branch banking, didn't see a single bank closure.

New Random Displays Display All By Ranking

About This Tool

The Great Depression refers to the serious economic crises that originated in the United States from 1929 to 1933 and spread to the entire capitalist world, including the United States, Britain, France, Germany, and Japan, and other capitalist countries. The Great Depression is the longest-lasting economic crisis in modern society, which caused massive unemployment and serious social problems, and finally led to the outbreak of World War II.

The Great Depression was not only a disaster for the stock market but also triggered a chain reaction in the economy of the world. The random tool explained 12 wrong things about the Great Depression that most people know.

Our data comes from Ranker, If you want to participate in the ranking of items displayed on this page, please click here.